Company tax lawyers are significantly certified that will help you to use discount charges in a way that will positively impact your organization, so why not take advantage? It could even have an incredible affect on your loved ones life. As one takes up tax accounting as a area, he/she should first seek the advice of an actual life tax accountant or not less than search for for the information on this profession and its requirements. There are particular situations will are available in your life that can make you expertise the steering from the tax attorney, and you have to take recommendation from the professionals. They’ll give you sound legal tax advice. They have the ability to provide you with sound authorized recommendation relating to handling your tax affairs. Get unlimited tax recommendation right on your screen from dwell tax consultants as you do your taxes, or have every thing executed for you-start to complete. R.S audits proper now. Audits might be very frustrating and traumatic. Expatriates can benefit from some great exclusions.

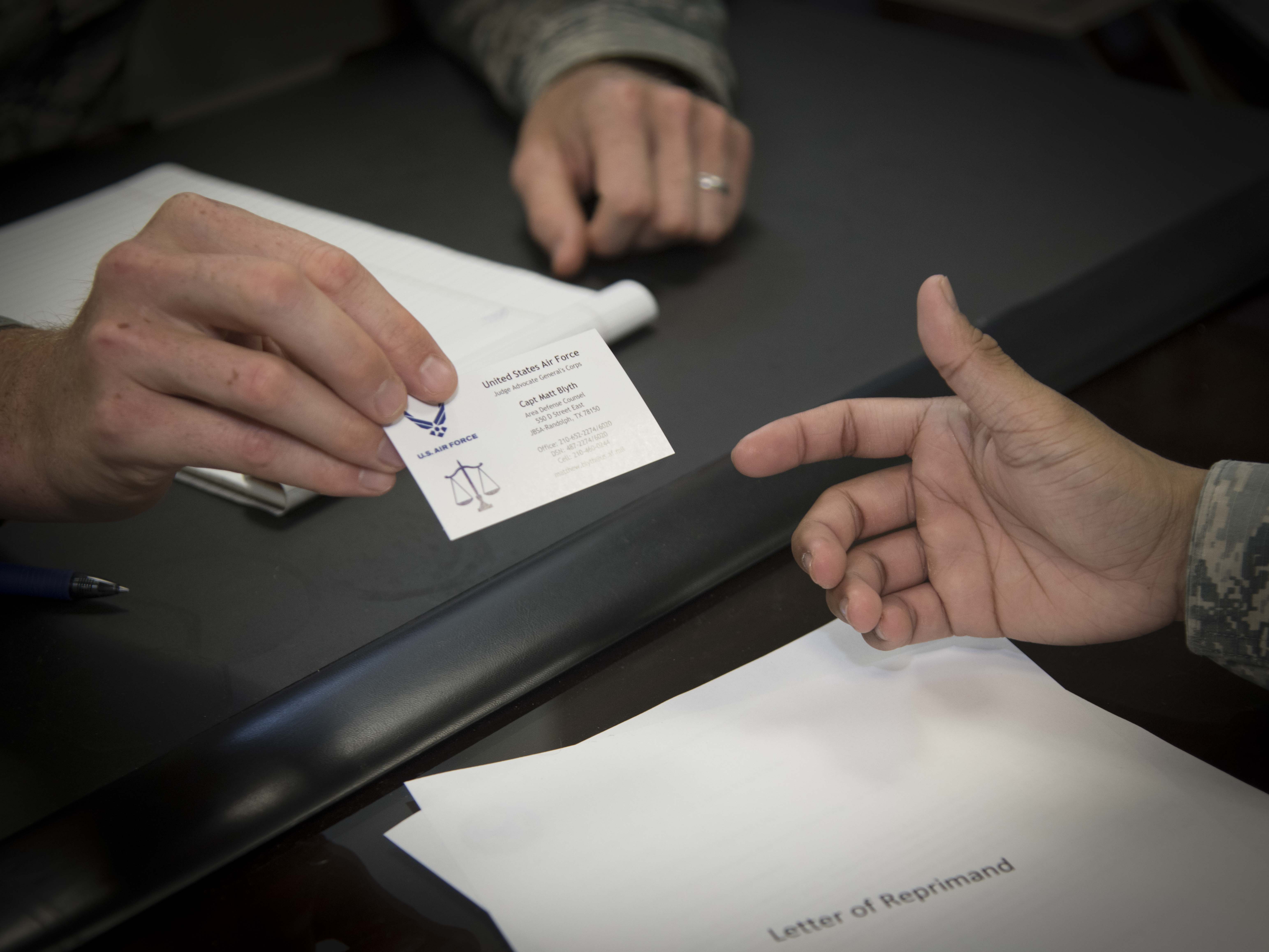

The first step when attempting to get the lien eliminated is to right away contact a tax relief attorney. In the event you were in bankruptcy when the lien was filed, you are also eligible to have the lien removed, as they can’t be positioned on already-defaulted accounts. I used to be willing to work in your accounts alone however pondering that it would be better to get a personal accountant near me. Consequently, the IRS will attach a lien, or a proper to take possession of property, to your private and enterprise property until the debt is paid. An expert criminal lawyer will be the one one that can guide you on this matter. A tax lawyer can guide you. In case you were injured in a vehicle accident, you aren’t going to need a family lawyer, the same as in case you are fighting for custody of your children, then a criminal lawyer or a tax attorney goes to be no use to you. If you would like your company to be as value-efficient as doable, (and who doesn’t?), speaking with with a company tax attorney about your alternatives regarding varied company varieties will be helpful because of the different tax required completely different varieties.

However, the very last thing you wish to do is to name the cellphone number that’s listed in your letter. One easy phone name can assist you to tremendously in terms of avoiding paying money to thieves. And, should you want legal illustration as a way to get your tax situation in order, they can assist you with that as nicely. Often, an IRS tax attorney is quite cautious in researching events adjoining to your situation and you should attempt to get nearly probably the most all-inclusive firm attainable. Seasoned tax discount. Your tax assist skilled ought to realize your needs like a enterprise supervisor for working money. If outlined tax accounting covers up vast subjects like the trucking owner operator tax accounting and taxation for building accounting. It took years of intense education and experience in accounting and auditing to get up to now, and together with that form of observe comes an innate savvy for getting that job completed.

A Tax accountant will help us in a very important type of method, he understands the taxation system on a wide account indeed hence he can be in a position to maintain us up to date relating to the adjustments in taxation like the rise and fall in the charges of deduction that are typically very fluctuating. You already know if you are the form of one that’ll be shopping for these. If you reside in Texas, you’ll know what I am hinting at. Thus far particulars embody a promise of a “centered mechanism for online video suppliers to obtain entry to sure NBC Universal content,” and that the newly formed entity will retain its financial stake in Hulu, while giving up its voting and board illustration rights. A certified tax reduction skilled is aware of that there is additional at stake for you personally than chopping a deal with the IRS to decrease your expenses – resolving you payroll tax difficulties is about preserving the economic long run of your respective agency. In that case, people pay lower sum than the required tax amount. Unfortunately, too many individuals are afraid of the IRS to rent an attorney and find out for sure.

Therefore, you’ll be able to at all times have the chance to hire some tax advising company who can conveniently settle your taxation state of affairs. Therefore, you’ll be able to benefit from his experience and evaluation and work carefully with him with a view to give you a better tax management plan. Reap the benefits of the power to pay schooling or medical expenses of a loved one. The IRS has very particular requirements for categories such as “gross income” and unable to analysis one thing beneath this category can have antagonistic reactions on your organization, via interest or expenses. Advanced Client Costs. Personal injury attorneys generally advance litigation bills to their shoppers with an expectation that they will be repaid within the event the lawsuit is profitable. In this state of affairs, it is to be noted that it is best to file a lawsuit against the cheater for letting the authority to take correct steps. Under such circumstances, you can all the time have the opportunity to hunt assist from the authority beneath the buyer Fraud Act. It is crucial that you simply seek the counsel of a criminal tax attorney before you attend the first meeting with the IRS agent to find out whether or not the offense was intentional. District Attorney Cyrus R. Vance Jr. opened the investigation in 2018 to study alleged hush-cash payments made to two girls who, throughout Trump’s first presidential campaign, claimed to have had affairs with him years earlier.

Both the district legal professional and the attorney normal, for instance, are examining how the Trump Organization and its brokers assessed the worth of Seven Springs, a 212-acre property north of Manhattan that Trump purchased in 1995. Trump’s company has stated the century-outdated, 50,000-sq.-foot mansion was used as a Trump household retreat. This complete debate around the purportedly high fees charged by New York tax attorneys is to quite an extent not justified at all since the reality is that these same professionals actually don’t cost all that a lot money as is typically made out to be.Instead, what we now have seen is that these professionals are really very cheap on the pricing front and that is indeed the explanation for which we at all times advocate that in relation to hiring New York tax attorneys, please don’t allow any of those price related issues to truly have an effect on the choice that you just make.Rather, you need to wholeheartedly be specializing in the immense value that these professionals are ready to offer, that too in such an amazingly consistent manner. Blocker’s hiring came after native officials efficiently advocated to add the new county judge seat in St. Johns County; the main target is to assist the court deal with calls for of inhabitants development.

“Tax is a technical and quick evolving authorized topic: it demands good verbal and analytical skills.” International tax law is especially demanding, provides Schwarz. “The guidelines governing tax returns are advanced, and a strong knowledge of the regulation is required,” stated NATP government director Scott Artman in a statement. In response, Lund stopped filing tax returns altogether and started creating many restricted legal responsibility companies (LLC) and trusts to conceal his revenue and assets. MINNEAPOLIS – As this year’s tax filing season involves an end, the U.S. Indeed the important thing to success in the tax accounting field is that a tax accountant needs to be versatile sufficient to simply accept and react to the unpredictable modifications in this subject, as solely then will he be capable of advise his clients on the current market conditions. Tax accounting is a much-diversified subject. With the explosive nature of the market, a tax accountant has to keep himself up to date almost about the day-to-day modifications within the taxation subject. Keep your head up, and keep hope. Proper manipulation in federal imprisonment tips.

This type if strategizing is required to lessen any type of imprisonment tenure to its half or easy wonderful. There are various strategies to keep away from the IRS overseas tax audit from changing into any sort of investigation concerning criminal tax. In conclusion, in case you are on the lookout for professional assist in order to improve your tax management system, you must definitely search out a new York tax attorney that will help you with this sort of issues, as he is the most suited individual for the job. Any one of those circumstances may result in getting your tax lien or levy reversed, but search the help of an knowledgeable if you find yourself with a lien on your property. A tax lien (also called a tax levy) merely put, it is what happens if you fail to pay your debts to the IRS for an extended sufficient period of time. The second circumstance occurs when the IRS did not follow correct procedures when inserting the lien. The first circumstance is when the debt has already been paid in full. One of the best half is that the attorneys will first evaluate your case without spending a dime. You might disagree in complete, or partly to the proposed changes.