Typically, if issues are found, the auditor may provoke an in-depth assessment. Since, in this situation, the tax assessed is based on inflated gross sales that have been never really made the business might face a tax burden that cannot be satisfied or leads to a seize of a substantial quantity of legitimate income. This return is never filed with the taxpayer’s finest curiosity in mind and sometimes ends in significant extra liabilities and penalties. However, it’s massively vital that you simply retain a tax attorney in Los Angeles to help you thru this process, because mistakes in filing can result in severe penalties or fines. For certain businesses that depend on licenses topic to suspension for unpaid gross sales tax, like liquor stores, a BOE audit that goes poorly can place your entire operation and group in jeopardy. The new York attorney normal’s workplace is investigating the Trump Organization and its officers in a wide-ranging investigation to find out whether it improperly inflated the value of assets to acquire loans and insurance or lowered the values to pay lower taxes. Both the district lawyer and the lawyer basic are additionally looking at 40 Wall Street, a Trump Organization skyscraper in Lower Manhattan, according to the state legal professional general’s court filings and other people acquainted with Vance’s investigation.

When that point comes for you, solicitors edinburgh can unquestionably be an ally in no matter unanticipated circumstance you might find yourself. You will definitely discover an ethical lawyer in Kunal. When i first referred to as Kunal I was very frightened because I had many years of FBARs and unreported overseas income. I called just a few attorneys. I employed Kunal to help me with a SDOP application after talking to some other tax attorneys. Received the IRS acknowledgement in a couple of months. If your case is won rapidly, Money might be saved due to the truth that you won’t be placing in months or even years together with your case being put off, paying for lawyer’s prices and courtroom bills. Manhattan prosecutors probing Trump’s actual-property enterprise for potential insurance and tax fraud have stepped up witness interviews in current months and hired forensic accountants, four individuals acquainted with the criminal probe instructed Reuters. Intended for solitary folks with absolutely no dependents, the total could possibly rival sixty %.

As noted above, one of the best approach to keep away from penalties for tax fraud is to file your return on time and guantee that it is one hundred p.c correct. I was nervous of the potential penalties ensuing from failure to report my international investments. Furthermore, discussions must also embody contingencies for potential issues including what’s going to happen if the auditor determines the paperwork are inadequate or she or he perceives problems or inconsistencies in the data. During these preliminary discussions ground guidelines for the audit needs to be mentioned and determined upon. Typically, a California gross sales tax audit conducted by a state auditor will start with an examination of the enterprise records. Furthermore, Los Angeles businesses in California and all through the United States have an obligation to account for, hold, and turn over payroll tax receipts to the U.S. California tax payers who proceed to collections at the state or federal level could face a lien on their property, a levy to seize their property or assets, or a garnishment on their wages.

If a federal extension is filed through IRS Form 4868 Application for Automatic Extension of Time to File U.S. U.S. District Judge Paul W. Grimm has scheduled sentencing for August 20, 2021 at 1:00 p.m. Attorney for the Southern District of Georgia. Which means a extremely skilled attorney is normally granted the work related to reviewing offers to advertise, obtain, house, lease related to terrain, terrain along with residence, residence, house along with accommodation served by owner in addition to enterprise. You might or could nicely not want a Ft Lauderdale tax lawyer for this kind or type of audit. Agreements could be chosen which package specially using the Leasehold as well as Freehold technique. As one can imagine, a non-representative sample could end result in the imposition of an overstated gross sales tax liability. Assess sales tax on this basis. Individuals whose actions increase pink flags in IRS or FTB methods are prone to face an audit or tax examination. Absent enterprise data, the proprietor and other accountable parties may face issue in proving the supply of money. Further, because of Los Angeles’ proximity to operations by Mexican cartels and situations of cash laundering on their behalf in L.A.’s Fashion District, EDD and other regulators watch money businesses intently.

However, the EDD realizes that transactions of this sort prevent a larger potential for abuse. Transactions often exacerbate the potential penalties of an EDD audit. • Use of structured transactions – Transactions made only to avoid tax obligations, cash reporting laws and other paper transactions with no financial substance can create fertile floor for an EDD audit. An especially egregious case came about in Wisconsin in 2015 when a multi-unit restaurant owner, his spouse, son and son-in-regulation, pleaded responsible to skimming more than $3 million in restaurant receipts from their eating places, expensing private expenses and paying workers in cash to avoid employment taxes. He labored patiently, efficiently and in professional method in resolving overseas taxes. Whether trying to cut back or remove your tax debt, our aim is to assist our purchasers avoid and solve any state and federal tax disputes in a well timed and cost-effective manner. We’ve helped several thousand purchasers with tax debt issues over the last two a long time.

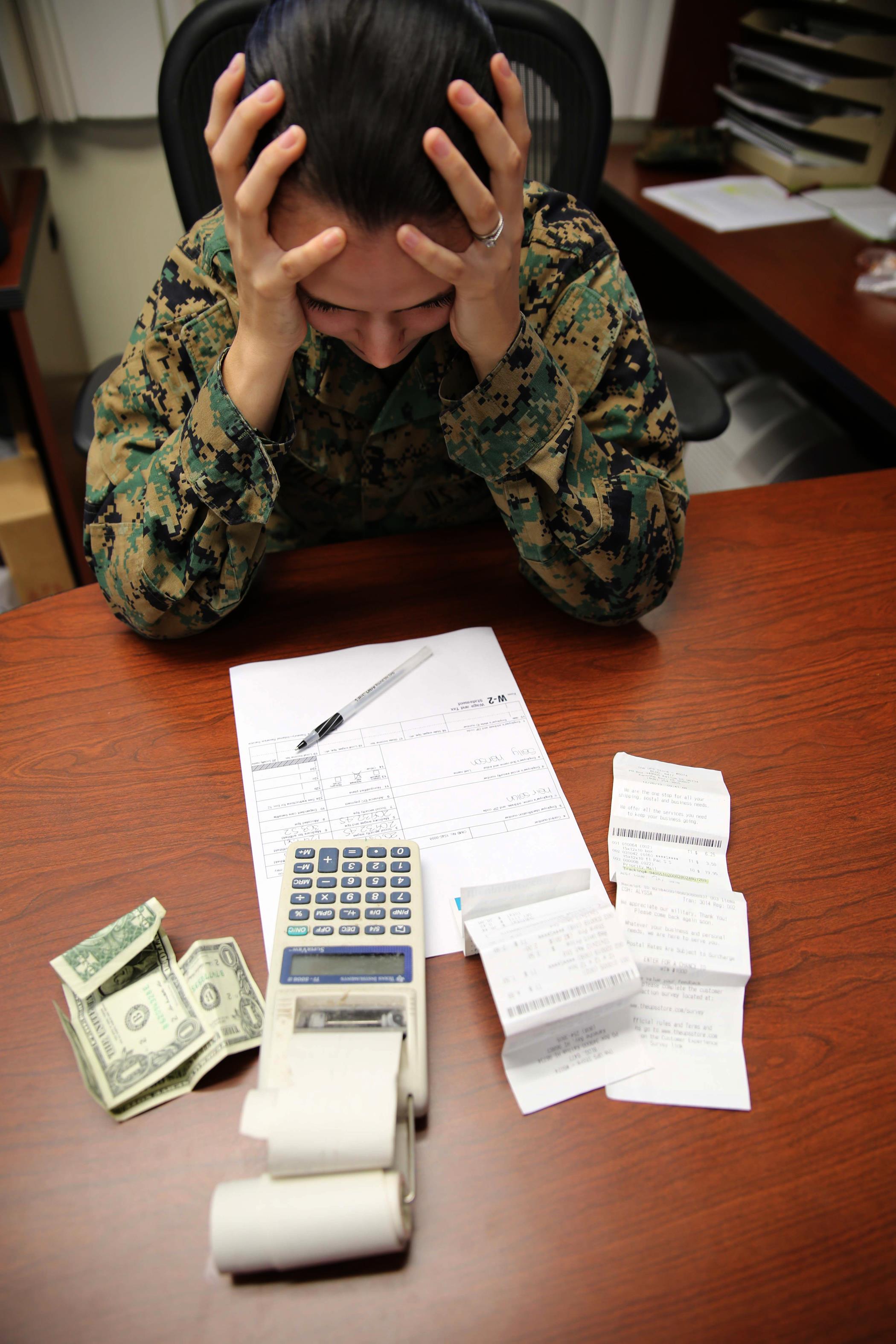

A tax professional will sustain with the latest changes and might advise purchasers accordingly and they could even be helpful when setting up trust funds, inventory portfolios and the like, so a taxpayer would not run into unexpected surprises on April 15th. When it comes to paying taxes, it is simply a matter of pay them now or pay them later. No matter what area of tax legislation and legal professional will select, there are particular qualities which might be requisite. There is no such thing as a shortage of opportunities for these seeking to enter into the tax legislation observe space. There are numerous who merely miss their deadline. Paying taxes by the deadline. Taxpayers in Los Angeles and beyond have an obligation to file and pay taxes. This obligation includes filing. An identical extension might be obtained for state tax obligations through the filing of FTB Form 3519 along with an estimated tax fee. Business owners should additionally ensure that their company’s books are in good order and that gross sales and payroll tax obligations have been accounted for and addressed. Generally, the records that must be kept merely begin with the normal books of accounts that a enterprise owner retains within the common course of business.

These taxes are typically referred to as trust fund taxes because though it is the business owner who accounts for and collects the tax, the money is definitely being held in belief for the U.S. Kim Reeves, a spokesperson for the U.S. His work in U.S. Lund replied together with his own letters claiming he was not a U.S. The IRS might send an array of notices or letters to tell the taxpayer of their choice for an examination or the agency’s want for added information. But whatever tax challenge you may be going through, whether or not you are involved about an IRS audit or want assistance planning a global estate, the Tax Law Offices of David W. Klasing can help. This may be because of completely couple of people utilizes their administrations. Our founder was an legal professional for the IRS for 14 years so we understand how to help folks take again control of their lives.

On March 5, 2021, a 54-yr-old Old Forge man was sentenced to 3 years of probation and ordered to pay $117,370 in restitution for tax evasion. In recent times, the BOE has cracked down on gross sales tax evasion and abuses including the use of zappers; devices that can alter sales information as a part of a scheme to keep away from gross sales tax. The county is a part of the 7th Judicial Circuit Court, which additionally includes Flagler, Putnam and Volusia counties. Therefore, penalties for payroll tax fraud and evasion are extreme and may, upon conviction, embody the imposition of personal legal responsibility on the part of the business owner or responsible get together. From April seventeenth, the video games will turn out to be a part of Capcom’s new budget lineup, “NEW Best Price! 2000,” and price a piffling ¥2,one hundred (slightly below $20) after tax. If you are not current within the USA for no less than 31 days in any taxation year, you will not be taxable. This timeframe is likely to be prolonged to a new forty-five days. As you would possibly imagine though, these numbers are practically impossible to determine.

For these confused by the foundations, listed below are key points. Penalties for state sales tax evasion are extreme. The IRS could remove the penalties and curiosity, provided you’ve justifiable causes for the non-payment. If I’ve a t-shirt store in Second Life and that i promote a t-shirt, what has changed? While most people wouldn’t require using a tax attorney, those who personal their own businesses or who’ve a large number of belongings are clever to seek the advice of a tax attorney along with the accountant that they use to be sure that they’ve covered all of the areas that should be coated for their enterprise or individual life to function within the bounds of the legislation, whereas not taking more of a tax hit then they need to, taking advantage of tax breaks that they is likely to be eligible to make use of. Thus, it turns into mandatory for all such folks to seek authorized recommendation from professionally qualified and very adept Property Tax Attorneys and Valuation Tax Attorney Texas as there is a slight difference between the legal procedures in dealing with property issues and the valuation of land, property and materials in any particular space in Texas.